Helping eliminate payment fraud and pay suppliers with confidence

PayOK verifies your suppliers bank account details before you make a payment, ensuring funds go to the correct account, every time.

WHY

The Problem

Every Australian business, regardless of size, location or industry, can be impacted by payment redirection, internal fraud and cybercrime.

$227 million

In losses in 2021 by Email Scams

> $2 billion

Lost by Australian's in 2021 from Reported Scams

3rd

Largest reported fraud is from false billing

Human Error

Not all payment errors are a result of fraud. Keying errors can result in mistaken payments that can be costly and are typically not refunded by your bank.

Social Engineering

Avoid the result of employees being manipulated and exploited via the rise of social engineering by cyber criminals.

Phishing Attacks

Cyber criminals can gain access to your system and manipulate data such as master vendor files to alter the recipient bank account details.

BEC

Fraudsters hack and take control of supplier emails in order to change invoices or bank details and redirect payments to their own account.

Employee Fraud

An employee changes a supplier’s bank account details within a pay run to either their own or another’s bank account to receive funds.

FEATURES

The PayOK Solution

PayOK offers a range of solutions to combat payment fraud, securely onboard suppliers and meet audit and compliance requirements.

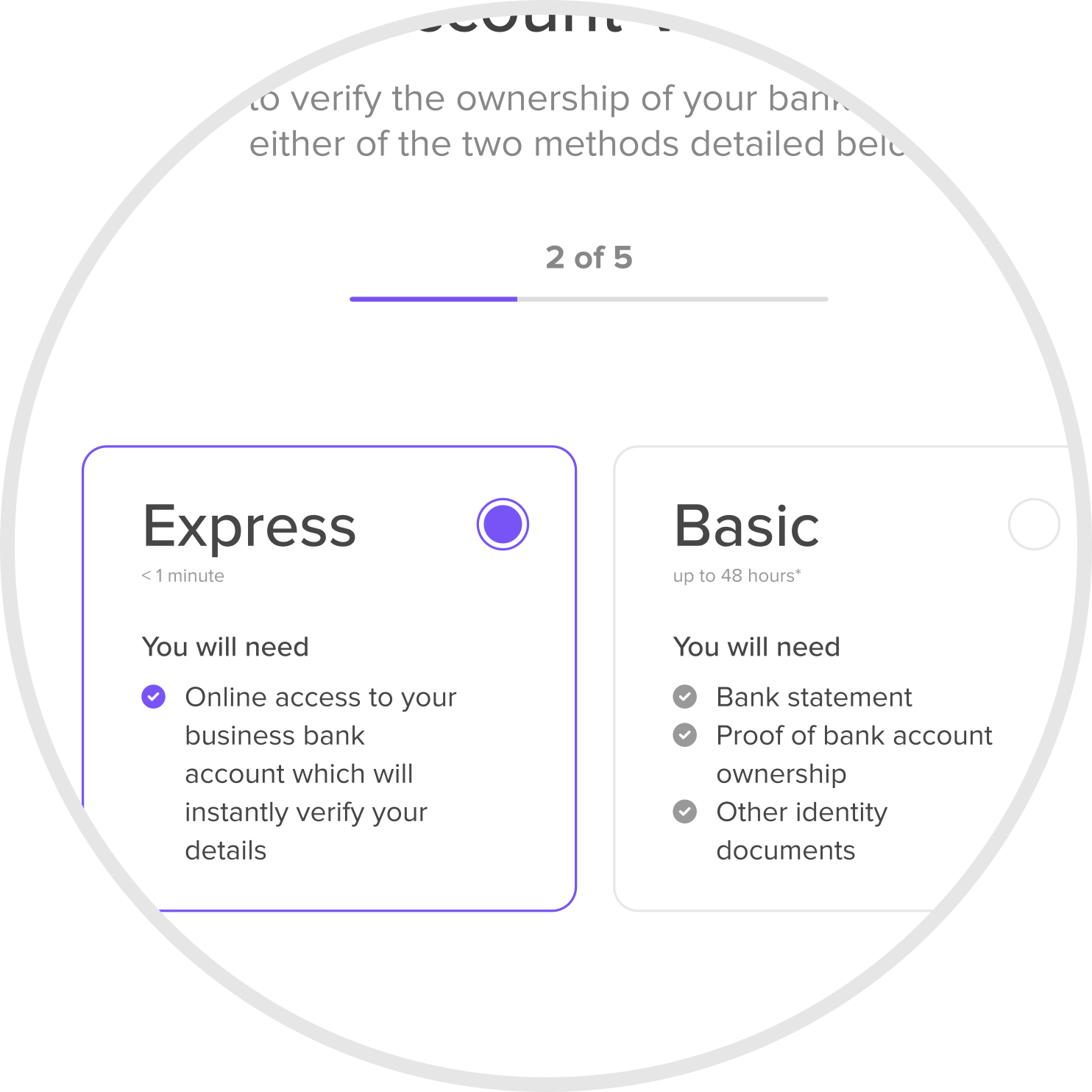

Verification

Consistency is Key; our Basic or Express verification options ensure that you follow the same process to verify vendor bank accounts every time regardless of volume.

Vendor Onboarding

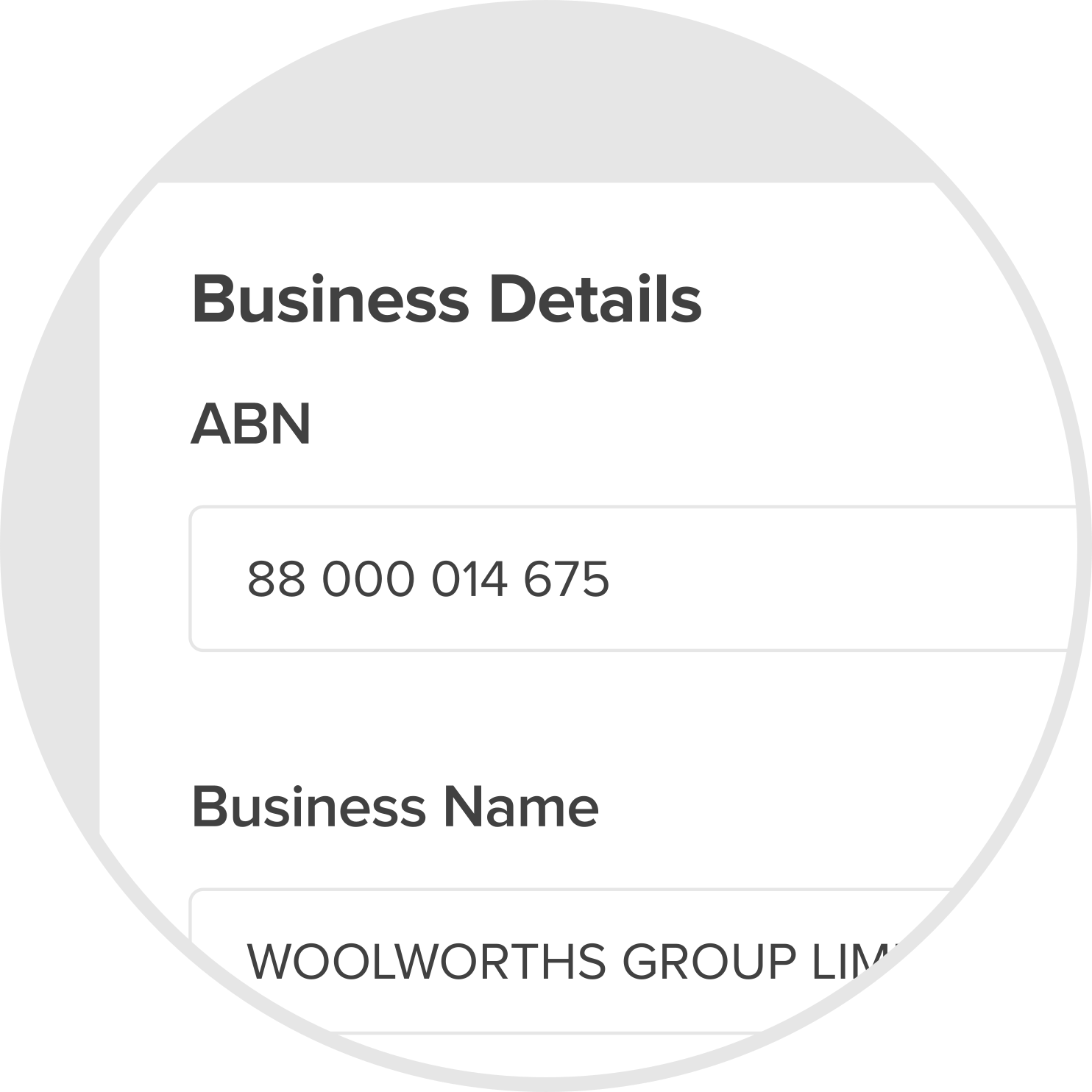

Digitise, customise, and automate your vendor application process. Ensure that once an application form is received all the required vendor information has been gathered, the ABN is validated, and their bank account credentials are verified.

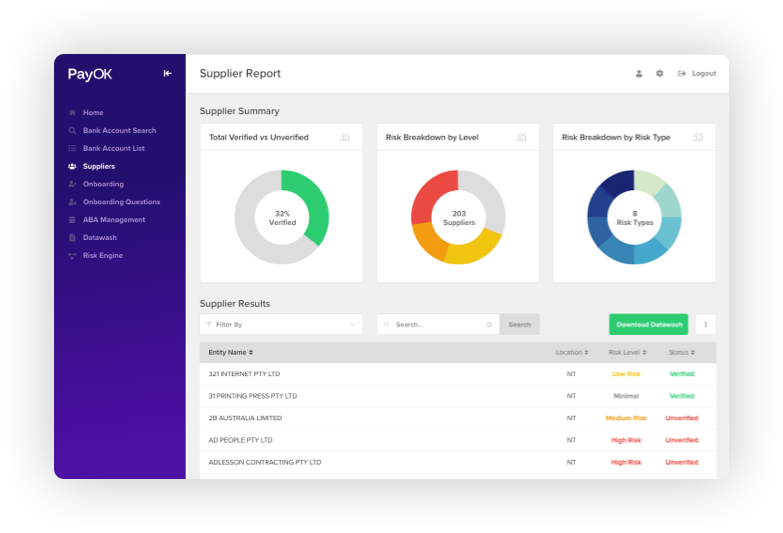

Vendor Management

PayOK reduces supply chain risk by keeping you up to date with ASIC, ABR and GST statuses. Managing payments against accurate vendor ABN’s is crucial for compliance to ATO Taxable Payments Reporting System. (TPRS)

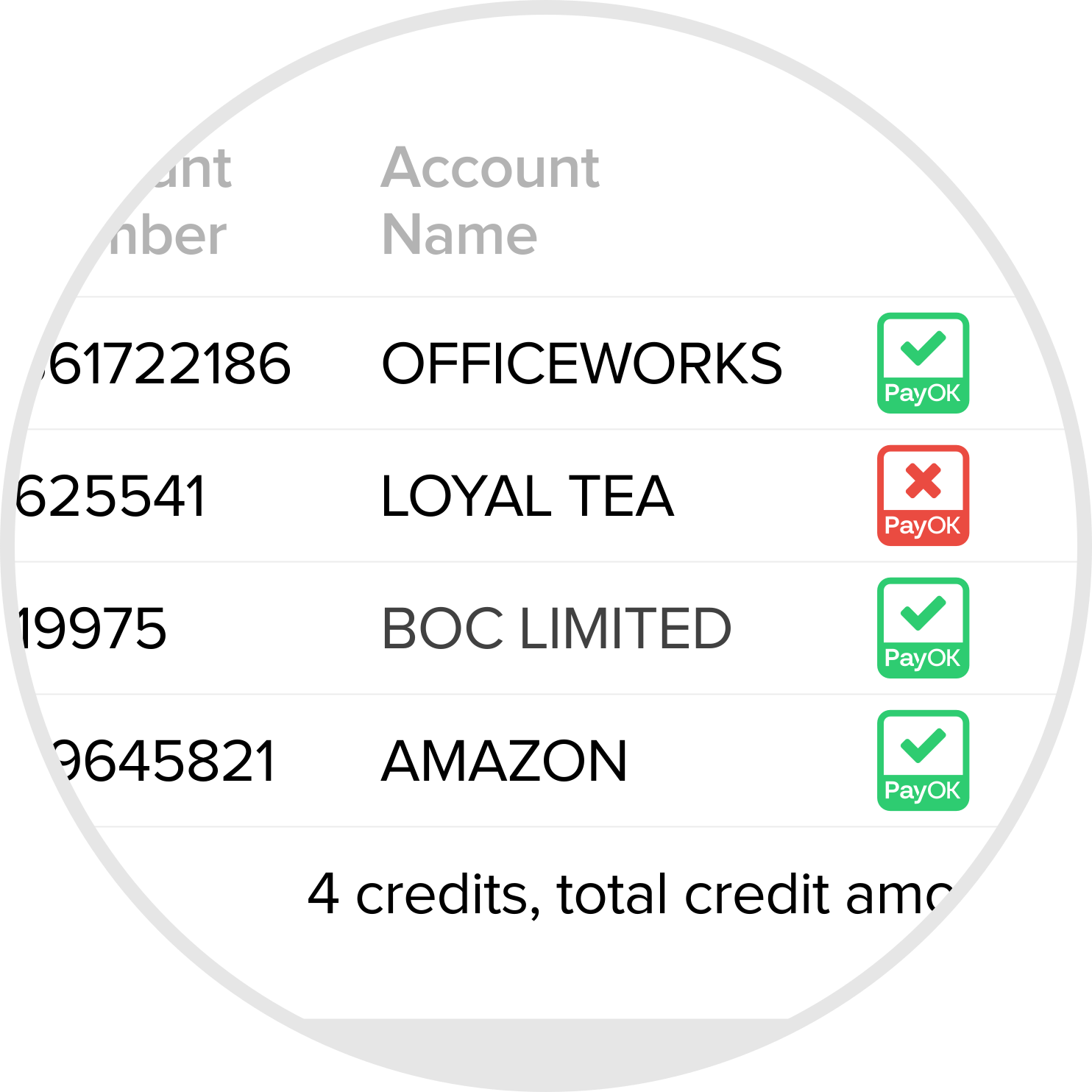

Payment Processes

Our Chrome plugin and ABA pre-check tool ensures that every payment is checked against the verified Master Vendor File before disbursement, including a check against employee bank account details.

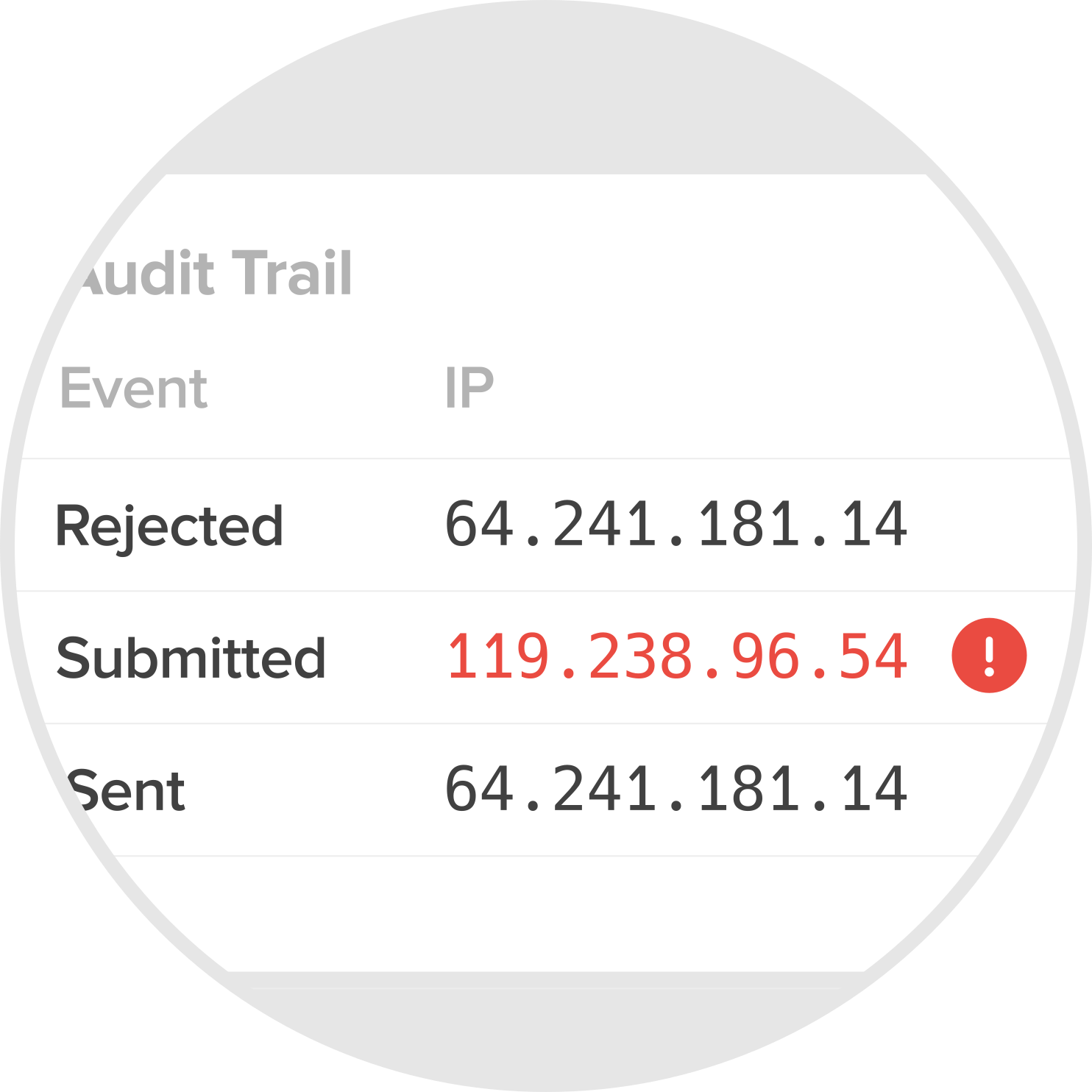

Audit and Compliance

PayOK has an automated audit trail of every verification, including user details, and IP address. We also provide an audit trail of every bank account payment when ABA files are uploaded.

Data Security

PayOK utilises bank grade encryption with AES-256 and SHA-512 means your data is safe from end to end. We leverage two-factor authentication and single sign on (SSO) to keep data secure.

HOW

See how it works

Discover the power of PayOK and how it can help your business improve supplier onboarding and reduce payment risk

VIDEO

Watch our two minute overview

Let us show you how we can improve supplier onboarding and help eliminate payment fraud in your business.

CONTACT US

Book a Demo Today

PayOK works with the best experts in the market to ensure we provide safe, secure and robust solutions for our clients.

OUR PARTNERS

Better together

We know that data and security matters, that's why we bring together comprehensive information presented in our easy to use platform

GET IN TOUCH

Schedule Your Demo Today

Speak to one of our advisors to find out how PayOK can help your business today